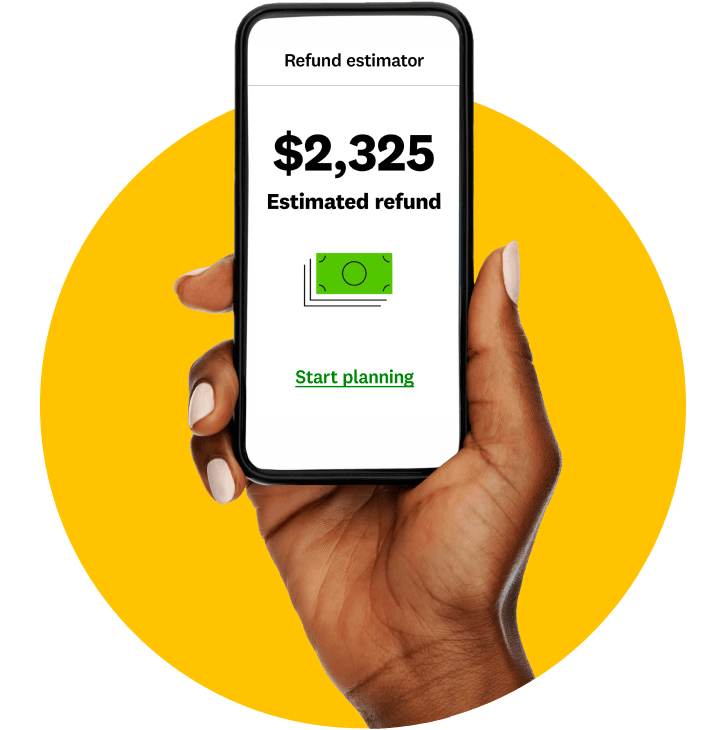

See your estimated refund now.

Changes to your life—and changes to tax rules—could impact your refund. Answer a few questions to see your estimate so you can start planning around those funds.¹

Image: hero-image

Image: hero-imageExplore features to minimize your time spent and

maximize your refund.

Image: Cash-Fast

Image: Cash-FastNeed money ASAP?

With Refund Advance², you could get up to $4,000 in your Credit Karma Money™ Spend account fast after the IRS accepts your return³. $0 Loan Fees and 0% APR. Terms apply. Don’t have a CK Money⁴ account? Get one now.

Image: Approved

Image: ApprovedMake the most of your tax refund.

Not sure about how to use your refund? We have ideas. Tap into our recommendation tool to see options for how to use your funds

Image: Increase

Image: IncreaseLift your credit with your refund.

You could improve your credit score by an average of 21 points in 4 days⁵ with Credit Builder⁶ from Credit Karma MoneyTM.

Study up for tax season.

Image: Mobile-Generic

Image: Mobile-GenericPayment app taxes: What you need to know about Venmo and PayPal taxes for 2023

Image: Cash-Bag

Image: Cash-Bag Image: Clipboard-4

Image: Clipboard-4 Image: Hand-Shake

Image: Hand-Shake- Your refund estimate is based on the information you’ve shared with Credit Karma and/or your tax return data from TurboTax. We will assume: the standard deduction is applied; all your income is taxed the same; if eligible, you received the Earned Income Tax Credit; and if eligible, you received the Child Tax Credit. This estimate will not support self-employed income or long-term capital gains.

- Loan details and disclosures for the Refund Advance program:

If you are receiving a federal refund of $500 or more, you could be eligible for a Refund Advance, a loan provided by First Century Bank, N.A., Member FDIC, not affiliated with MVB Bank, Inc., Member FDIC. Refund Advance is a loan based upon your anticipated refund and is not the refund itself. 0% APR and $0 loan fees. Availability of the Refund Advance is subject to satisfaction of identity verification, certain security requirements, eligibility criteria, and underwriting standards. This Refund Advance offer expires on February 15, 2024, or the date that available funds have been exhausted, whichever comes first. Offer and availability subject to change without further notice.

Refund Advance is facilitated by Intuit TT Offerings Inc. (NMLS # 1889291), a subsidiary of Intuit Inc. Separate fees may apply if you choose to pay for TurboTax with your federal refund. Paying with your federal refund is not required for the Refund Advance loan. Additional fees may apply for other products and services.

You will not be eligible for the loan if: (1) your physical address is located outside of the United States, a US territory, a PO box or a prison address, (2) your physical address is in one of the following states: IL, CT, or NC, (3) you are less than 18 years old, (4) the tax return filed is on behalf of a deceased person, (5) you are filing certain IRS Forms (1310, 4852, 4684, 4868, 1040SS, 1040PR, 1040X, 8888, or 8862), (6) your expected refund amount is less than $500, or (7) you did not receive Forms W-2 or 1099-R or you are not reporting income on Sched C. Additional requirements: You must (a) e-file your federal tax return with TurboTax and (b) open a Credit Karma Money Spend (checking) account with MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply. Opening a Credit Karma Money™ Spend (checking) account is subject to eligibility. Please see Credit Karma Money Spend Account Terms and Disclosures for details. NOTE: If you previously opened a Credit Karma Money™ Spend (checking) account and that account has been closed, you will not be eligible for Refund Advance.

Not all consumers will qualify for a loan or for the maximum loan amount. If approved, your loan will be for one of ten amounts: $250, $500, $750, $1,000, $1,500, $2,000, $2,500, $3,000, $3,500, or $4,000. Your loan amount will be based on a portion of your anticipated federal refund to a maximum of 50% of that refund amount. You will not receive a final decision of whether you are approved for the loan until after you file your taxes. Loan repayment is deducted from your federal tax refund and reduces the subsequent refund amount paid directly to you.

If approved, your Refund Advance will be deposited into your Credit Karma Money™ Spend (checking) account, typically within 4 minutes after the IRS accepts your e-filed federal return and you may access your funds online through a virtual card. Your physical Credit Karma Visa Debit Card* should arrive in 7 – 14 days. *Card issued by MVB Bank, Inc., Member FDIC pursuant to a license from Visa U.S.A. Inc.; Visa terms and conditions apply. Third party fees may apply.

If you are approved for a loan, your tax refund after deducting the amount of your loan and agreed-upon fees (if applicable) will be placed in your Credit Karma Money Spend (checking) account. Any remaining balance of the funds will be placed in the same Credit Karma Money Spend (checking) account once the funds are disbursed by the IRS, which is typically within 21 days of e-file acceptance. If you apply for a loan and are not approved, your tax refund minus any agreed-upon fees (if applicable) will be placed in your Credit Karma Money Spend (checking) account. - IRS accepts returns starting late-Jan. Acceptance times vary. Most customers receive funds within 4 minutes of acceptance.

- Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account.

- Members with a TransUnion credit score of 619 or below who opened a Credit Builder plan and had it reported on their TransUnion report saw an average credit score increase of 21 points in 4 days of activating the plan. Late payments and other factors can have a negative impact on your score, including activity with your other credit accounts.

- Credit Builder plan requires you to open a no-fee line of credit and a no-fee savings account, both provided by Cross River Bank, Member FDIC. Credit Builder is serviced by Credit Karma Credit Builder. You’re eligible to apply for Credit Builder if your TransUnion credit score is 619 or below at the time of application. A connected paycheck or QDD is required for activation. For QDD, must be received in the current or prior month before application, or 90 days after application submission.